The announcement by the Bank of Jamaica (BOJ) that it has increased interest rates in an effort to control inflation has raised eyebrows and initiated discussion among the public who are awaiting some understandable reason for the action. While the use of interest rate policy is a valid remedy for an economy that is overheating, it cannot be a one tool for all in its application.

Economies are not always similar in how they respond to monetary and, for that matter, fiscal policies. So, from a global perspective a single focus does not mean that all generic prescriptions will work for every patient, and that is a basically accepted principle in pharmaceuticals, research and application regimes. Their literature is required to show allergies, reactions, non-compatible drugs; and this serves to signify the acceptance that all humans are not identical.

International prescriptions for all countries in a generic way cannot be accurate and effective. An economy has mixed proportions of elements such as GDP; labour productivity; government policies on restrictions or easement; social and cultural acceptable norms; folklore; political cycles and popularity; undue sectoral pressure; exports vs imports; natural resources; levels of ownership; family structures; and many more potential variables.

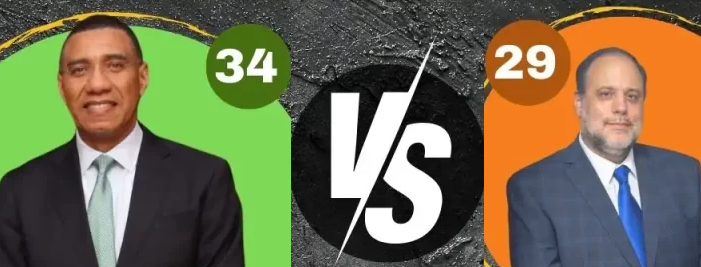

The point is that one size does not fit all. Many people believe that this interest rate policy is the “brainchild of the IMF” and there have been decades of policies that have worked; others that have failed; yet some that have never been tried because of fear of political unpopularity. Somewhere in this milieu lies the truth of this interest rate rise, and we must analyze it properly.

A place to start must be the economy as this is the object of the BOJ’s control. Is it expansionary or contractionary in the view of the BOJ or IMF? In the situation of Jamaica, the size of the economy is broadly (perhaps not accurately) official; and unofficial (grey); and today a criminal ( yet to be described). Weighting related prescriptions cannot be calculated by not knowing or guessing an important variable.

We have no information from the IMF; BOJ; PIOJ; or STATIN that properly estimate or jointly analyze figures that are plausible. Most analyses are not done on a real-time basis, they’re often some months behind. The communications processes and lack of sufficient data collection and computer analysis seem to lag far behind “real time”.

Additionally, large, medium, and small manufacturing do not always supply timely or accurate input and output data as they are secretive or may prefer to operate below the line of scrutiny. In addition, few reveal differentiated domestic or export performances by unit measure.

In addition we compare data of a period of two fiscal years and take it to be “gospel”. So we say 2021 1st Q versus 2020 1st Q, when both are in the heights of a pandemic, seems to be an unambitious comparison. So results look artificially bad or good even as we recognize the economy as an ongoing and volatile variable. This can result in several erroneous assumptions, and calculations of potential at a crucial recovery period of outcomes and remedial actions.

A pandemic year comparison must impact employment in a negative year, and I accept air transportation and cruise shipping are declining industries. But gross reserves are high, so where is that coming from? Remittances have grown by double digits, but tourism and bauxite have declined and agricultural exports are low. The purchasing power for the average Jamaican should be down and not a contributor to inflation.

The inflation caused by high oil prices and the skyrocketing freight rates are beyond the control of the BOJ so why would the bank want to exacerbate this by taking actions that will not curb inflation nor the value of the dollar as it continues to fluctuate?

The standard IMF prescription has been a call to reduce employment in the public sector, a call that has been resisted by successive Jamaican governments. After all, that could lead to the loss of elections. So far both parties have only pretended to be engaged in doing job evaluations and assessments and efficiencies. It is all smoke and mirrors to appease the standard IMF “recommendations”. Remember the fictional book Wildcat’s Revenge by Claude Balls, this could be simply teaching us a lesson.

So if we are not all starving yet, then where is the money coming from? Please recall the drug finds up to this week. Remember Hon. Minister of Health and Wellness detaining a boat said to be coming for drugs, well where are they now? Also a plane (jet) crashing seemingly heading for Vernamfield. Where are the occupants, or 700 lbs of cocaine at NMA, who was arrested?

Should we expect that the IMF; PIOJ; STATIN; or the BOJ have any idea of how to measure the impact of drugs trafficking; or the guns for drug trade? I think not. However, they should know before taking actions like raising interest rates without sharing complete information.

These are just a few questions that need consideration and good answers. However, I am not holding my breath.